English Tax Form Sa108 Residence Remittance Basis Etc from HM Revenue and Customs Lies on Table with Office Items. HMRC Paperwork Editorial Stock Photo - Image of majesty, british: 190607343

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

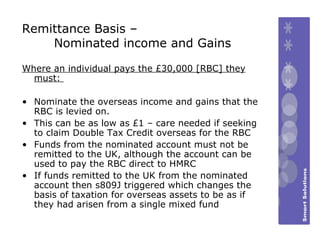

Malta: Commissioner publishes first ever guideline on remittance basis of taxation | International Tax Review

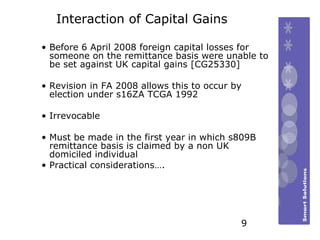

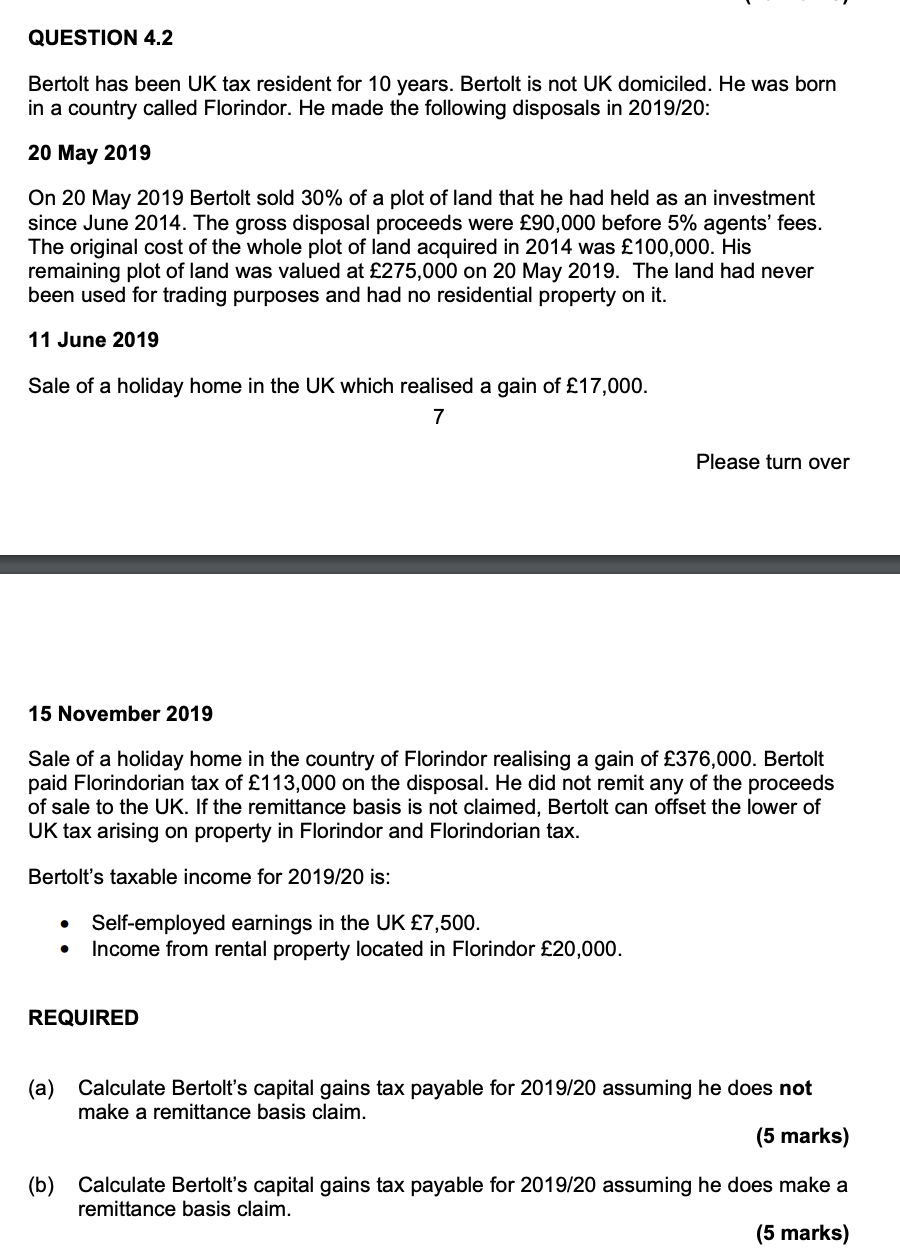

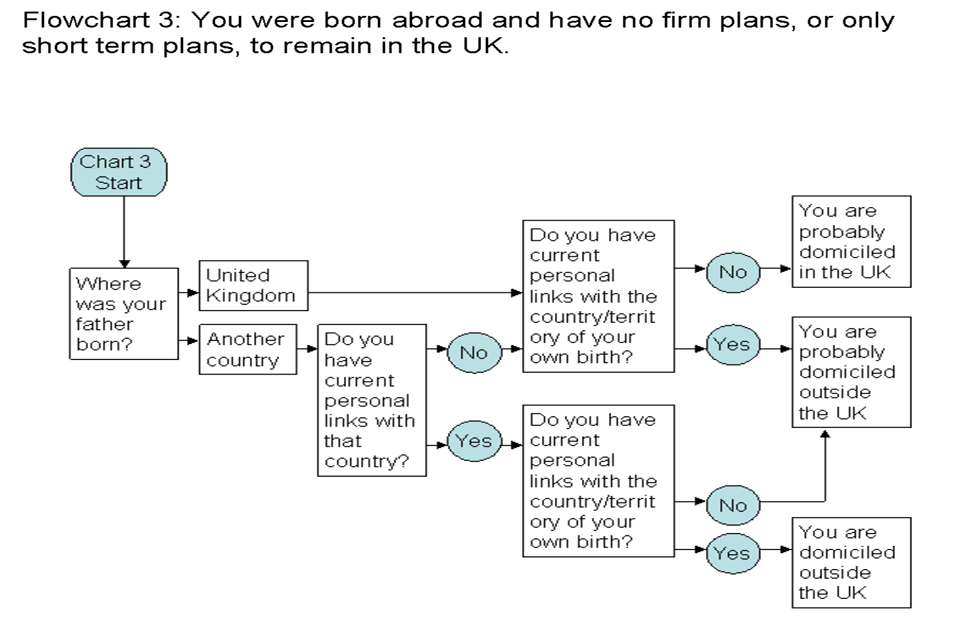

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

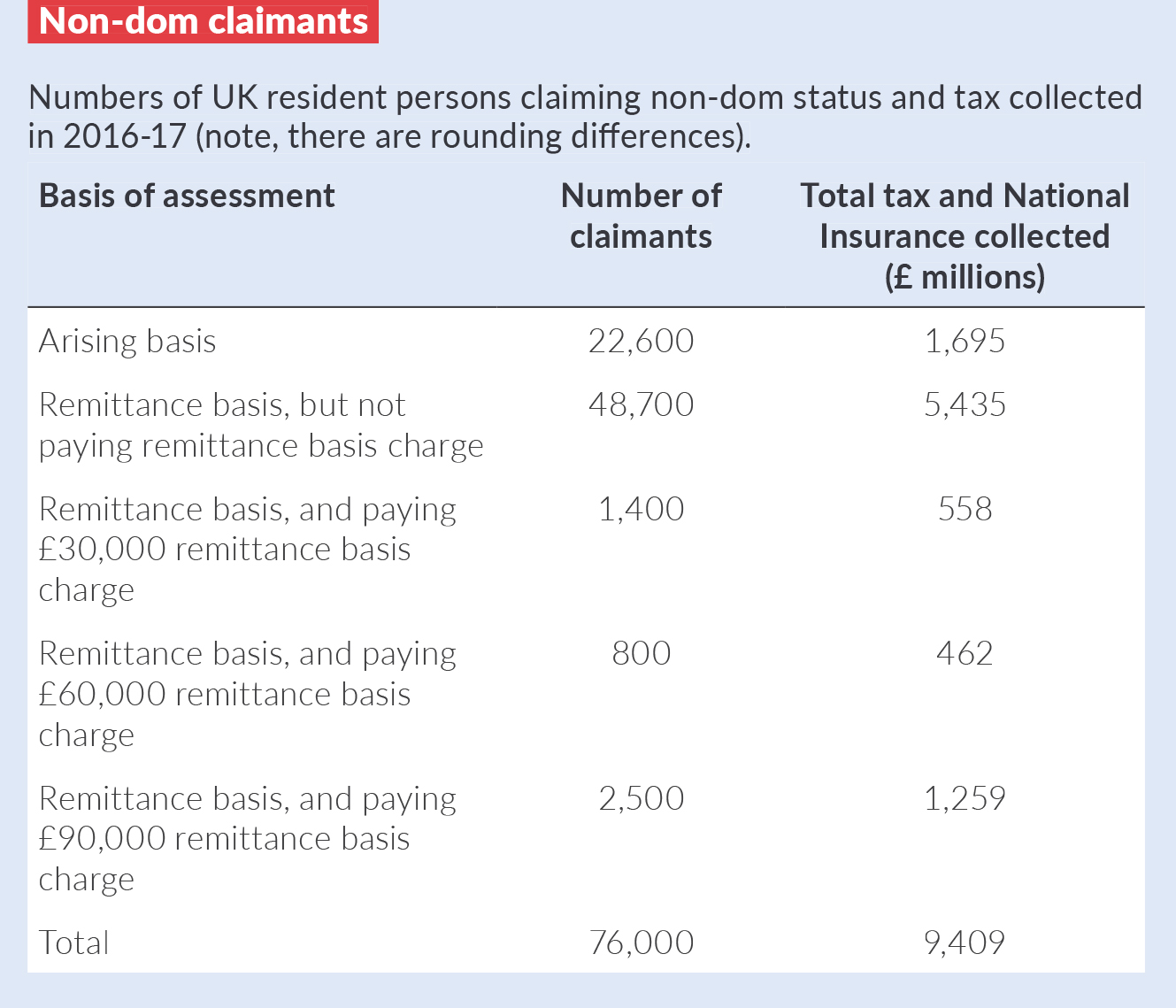

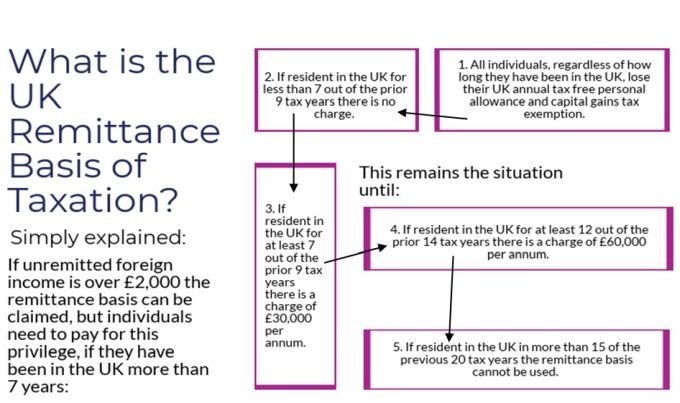

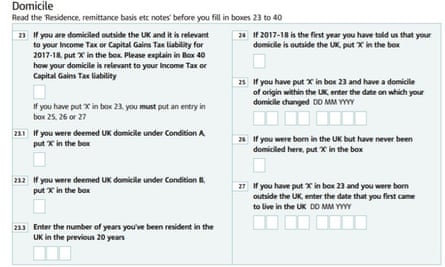

Akshata Murty's non-dom status is a choice not an obligation – tax experts | Tax and spending | The Guardian