![Chapter 5: Risk Management and Hedging Strategies - Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification [Book] Chapter 5: Risk Management and Hedging Strategies - Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification [Book]](https://www.oreilly.com/api/v2/epubs/9781118339343/files/images/c05u001.jpg)

Chapter 5: Risk Management and Hedging Strategies - Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification [Book]

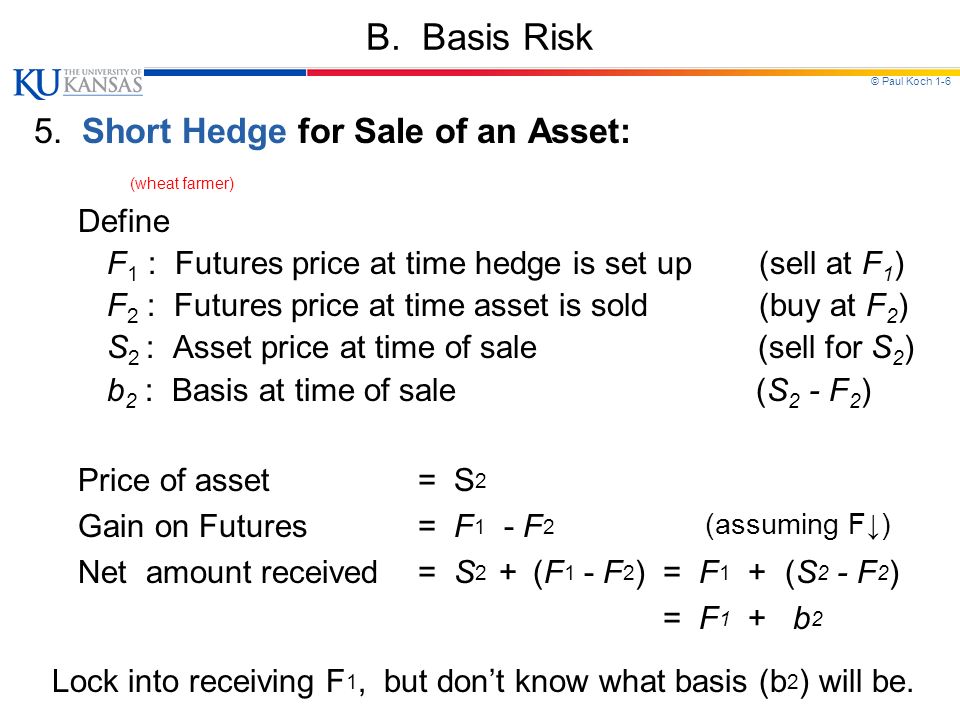

Hedge effectiveness: Basis risk and minimum‐variance hedging - Castelino - 1992 - Journal of Futures Markets - Wiley Online Library

:max_bytes(150000):strip_icc()/Investopedia-terms-hedge-fb11c495608344c395cafdb63213a1a7.jpg)